Founded in 2004, Momentum has deployed billions in capital and evolved through six successful iterations. But our success isn’t measured in miles of pipeline or projects completed — it’s reflected in the trust we’ve earned and the impact we’ve made on our industry.

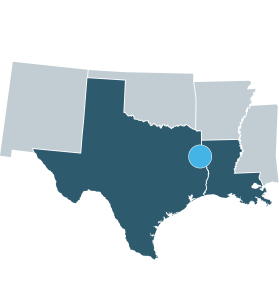

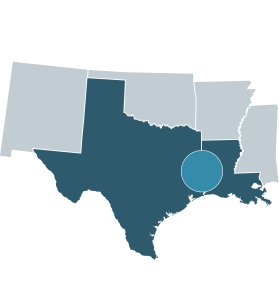

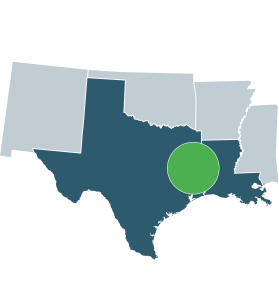

Today, our growth-focused strategy positions us to capitalize on new opportunities and create long-term value through the development of integrated gathering, processing, and transportation assets that connect Haynesville supply to premium Gulf Coast industrial, power, and LNG markets.